Advances in Economics, Management and Political Sciences

- The Open Access Proceedings Series for Conferences

CATEGORIES

Current Volumes

Volume Info.

-

Title

Proceedings of the 3rd International Conference on Business and Policy Studies

Conference Date2024-02-27

WebsiteNotesISBN978-1-83558-381-4 (Print)

978-1-83558-382-1 (Online)

Published Date2024-04-30

EditorsArman Eshraghi, Cardiff Business School

Articles

-

Open Access | Article 2024-04-26 Doi: 10.54254/2754-1169/79/20241320

Disparities in Correlation Between Total Revenue and EPS: The Influence of R&D and Regulatory Environments in Tech and Pharmaceutical Industries

In the realm of financial analysis, discerning the correlation between total revenue and Earnings Per Share (EPS) serves as a pivotal indicator of a corporation’s financial stability and potential for growth. This research navigates through the divergent pathways of the tech and pharmaceutical industries, elucidating a marked correlation in the former and a distinctly subdued one in the latter. By immersing into an incisive analysis that encompasses industry-specific attributes, market dynamics, and financial protocols, this paper not only shines a light on the disparities in the revenue-EPS correlation across these industries but also posits that the divergences can be substantially attributed to the disparate R&D investment strategies and regulatory environments that inherently characterize them. The encapsulated findings offer a refined lens through which the financial undercurrents of pivotal industries can be examined, providing foundational insights for investors and policy-makers alike.

-

Open Access | Article 2024-04-26 Doi: 10.54254/2754-1169/79/20241343

Enforceability of International Economic Law in the Context of National Power Differentials

Under the background of global politicisation and economisation, international trade has become the main mode of communication among countries. With the explosive growth of international trade volume, human society will face trade discrimination and inequality, so human beings have set up the International Trade Organisation (ITO), which supervises the process of international trade and formulates the relevant international economic laws in order to better guarantee the sustainability of the economic cycle and protect the rights and interests of the disadvantaged countries. However, as time goes by, we can see that in reality most developing or third world countries are still unable to defend their legitimate interests and are at a disadvantage in most transactions. So this study will be based on the difference in the strength of the different countries and the structural shortcomings of the Global Trade Organisation. This paper will analyse why disadvantaged countries are still unable to obtain equal opportunities for development in the international community, which now has a more comprehensive legal system.

-

Open Access | Article 2024-04-26 Doi: 10.54254/2754-1169/79/20241872

When Would Owners Decide to Block Their Properties? Deciphering the Airbnb Business Decisions with Transactional Data

The sharing economy create a new model for the society to provide the properties with different status which is not be full-utilized by the host. Airbnb is a typical example, which allows the host to provide their rooms to the customers. Our work focus on the micro level to show the relation. Using the anonymous data of properties in New York City from Airbnb, we estimate the effects of properties’ status on market performance and supply behaviors. Our result shows that the higher daily rates would lead to higher booking numbers. However, the extra fee such as clean fee and Security Deposit will do negative effects on number of booking. Further more, Convince and information availability cause better performance. Supply behaviors will not be changed easily. However, we found that the weekend, higher price and lower annual revenues will lead to higher probability of block.

-

Open Access | Article 2024-04-26 Doi: 10.54254/2754-1169/79/20241747

Bitcoin Price Prediction Based on Multiple Machine Learning Algorithms

In this paper, we performed bitcoin price prediction based on bitcoin price dataset using Support Vector Machine model, Random Forest model, Neural Network model, XGBoost model and LightGBM model and evaluated the performance of these models. We divided the Bitcoin price dataset into training and test sets in a ratio of 7:3, where 70 were used as the training set and 30 as the test set. The models were trained with the training set and tested with the test set using the stock price change (yield) as the target variable and other variables as input variables. By comparing the MSE, RMSE, MAE, MAPE and R² of the different models were evaluated and it was found that XGBoost has the best performance and the best prediction. The performance of the other four models ranged from good to poor, including LightGBM, Random Forest, Support Vector Machine and Neural Network. Among them, the neural network, whose MSE is tens of times higher than the other four models, performs the worst. The research results in this paper can provide reference value for future Bitcoin price prediction, and also provide some reference for choosing appropriate machine learning models.

-

Open Access | Article 2024-04-26 Doi: 10.54254/2754-1169/79/20241874

Behavioral Finance: The Impact of Investor Expectation on Financial Decision-Making

Behavioral finance challenges traditional financial theories by questioning the assumption of investor rationality, highlighting the influence of cognitive biases, emotions, and psychological factors on decision-making. This deviation from conventional models like the Efficient Market Hypothesis recognizes the complexity of human decision-making in financial contexts. The field focuses on key phenomena: loss aversion, market anomalies, the framing effect, and the endowment effect. Loss aversion reveals a stronger reaction to losses than equivalent gains, influencing overly cautious decisions. Market anomalies, such as momentum and trend reversals, challenge efficient market expectations. The framing effect shows how decision-making is swayed by information presentation. The endowment effect impacts perceived asset value, affecting financial decisions. These biases significantly impact investor behavior, potentially leading to suboptimal portfolio choices. Recognizing these biases is crucial for making informed financial decisions. Behavioral finance research has profound implications, emphasizing the integration of behavioral insights with traditional models. Future studies should explore cumulative behavioral effects, conduct cross-cultural analyses, and investigate diverse market conditions for more effective investment strategies and regulations. Understanding global financial behavior through behavioral finance is essential for comprehensive insights into market dynamics and decision-making processes.

-

Open Access | Article 2024-04-26 Doi: 10.54254/2754-1169/79/20241769

Marketing Strategy Analysis in the Digital Era— Taking Pinduoduo as an Example

In this study, the researcher will assess the marketing strategy analysis of Pinduoduo, a Chinese e-commerce giant that, over the past few years, has gained prominence and increased its market share against traditional e-commerce companies such as Alibaba and JD.com. In this study, the researcher will examine the effectiveness of the evolving online marketplace, focusing on the company’s unique business model and strategies such as time-limited instant kills and social media marketing to develop a better understanding of the impact and success of Pinduoduo’s approach. The methodological approach that the researcher will use is a comprehensive literature review and the SWOT model to understand Pinduoduo’s digital marketing strategies. The literature review approach will focus on the core business model of the company, while the SWOT model will be instrumental in analyzing market positioning and segmentation. The key questions in this study include: conducting an assessment of the efficacy of Pinduoduo’s marketing plan; understanding its digital marketing trends; and drawing insights from global success stories in the industry. Pinduoduo’s marketing strategies that have led the company to effectively engage users, specifically those from low-tier cities, include time-limited instant kills, daily cash rewards, and subsidies. The SWOT analysis has helped the company identify strengths, such as market differentiation, and weaknesses, such as high unit prices. In conclusion, Pinduoduo’s success will be based on its ability to successfully navigate the sinking market and its successful utilization of its strategic innovations, making it a formidable player in the digital era.

-

Open Access | Article 2024-04-26 Doi: 10.54254/2754-1169/79/20241884

A Study on the Financial Situation Changes of Major A-share Real Estate Companies Since the Adjustment of Purchase Restriction Policies

To prevent over expansion of property bubbles in China, housing purchase restriction policies were put into effect in 2010. Nevertheless, to be adaptable to economic conditions at that time, there was firstly a relaxation of housing purchase restriction policies in 2014 and after that, several more adjustments were made. By analyzing the financial indicators of the main real estate enterprises in A-share market, this paper wants to find the general trends and common features of those corporations under policy adjustments and changeable market environment. The analysis results show that the majority of firms kept high levels of debt and inventory all the time and from 2014 to 2019, most companies’ net income margins, net income and operation revenue generally kept increasing. However, as the Coronavirus pandemic broke out at the end of 2019, those profitability measures started to decrease widely and sequentially, even with a new round of policy easing. Facing with this situation, it is suggested that to prevent debt risks, property enterprises could take deleveraging and destocking into consideration and to achieve a soft landing of the housing market, new ways of policy adjustment could be implemented by the government.

-

Open Access | Article 2024-04-26 Doi: 10.54254/2754-1169/79/20241772

Cost Benefit Analysis of Vehicle Emissions Reduction Policies in Canada: A Case Study of Zero-Emission Vehicles

Canada has been at the forefront of mitigating climate change by adopting strategies that align with the international objective of limiting global warming. For instance, the Canadian government has intervened in the transport sector by enacting vehicle emission reduction policies such as the ZEVs policy that encourages the adoption of EVs, FCVs, and PHEVs. The policy aligns with the Canadian government’s ambitious target of getting more ZEVs on Canadian roads as a strategy to achieve “100 percent zero-emission vehicles by 2040, with interim goals of 10 percent by 2025 and 30 percent by 2030”. However, although ZEVs offer Canada an opportunity to reduce its GHG emissions in the transport sector, there has been concern about the upfront costs associated with adopting ZEVs, which continue to be a major deterrent despite their operation and maintenance costs being low. The following research paper conducts a CBA on ZEVs compared to CVs in Canada in terms of ownership costs and environmental impact.

-

Open Access | Article 2024-04-26 Doi: 10.54254/2754-1169/79/20241773

Digital Intelligence Enables Silicon Carbide Supply Chain Upgrade

From the perspective of supply chain management, the silicon carbide supply chain currently exists in the technical force is low, the development situation is poor, as well as the traditional silicon-based devices still occupy the relevant areas of the market, silicon carbide in addition to the urgent need for breakthroughs in the field of technology, due to the adjustment and transformation of the industrial structure as well as the upstream production capacity expansion makes the silicon carbide industry is also faced with the lack of supply chain management capabilities and the backwardness of the management structure. This is also the core element that this paper will focus on. The research theme of this paper is how to complete the transformation and upgrading of the silicon carbide supply chain through the role of digital intelligence, to effectively increase the production capacity of silicon carbide and change the current production dilemma. To this end, this paper focuses on the feasibility of solving the existing problems of the silicon carbide supply chain by upgrading the supply chain empowered by Digital Intelligence. The results of this paper are based on the successful reform experience of the steel industry, through management restructuring, supply chain expansion, industry chain extension, improving industrial technology, manufacturing to service transformation, and the combination of digital intelligence technology for industrial restructuring, to increase the production capacity of the silicon carbide industry.

-

Open Access | Article 2024-04-26 Doi: 10.54254/2754-1169/79/20241886

Research on the Social Media and Online Sales

The role of social media in marketing and e-commerce has grown exponentially as the Internet has had a transformative influence on consumer behavior. And, the trend of online shopping is gradually becoming the dominant way of consumption and surpassing the traditional sales model, particularly in the context of the significant impact of the COVID-19 pandemic. The article highlights key findings related to the efficient use of social media as a marketing channel, customer engagement strategies, selection of social media platforms, and maximizing return on investment through the literature review and theoretical analysis. This research also illustrates the practical implications of these trends with a case study of Amazon's online versus traditional brick-and-mortar retailing. In addition, the article underscores the importance of understanding and leveraging the power of social media platforms for businesses looking to thrive in the digital age. It predicts a promising future for social media platform sales with continued growth and evolving opportunities for businesses.

-

Open Access | Article 2024-04-26 Doi: 10.54254/2754-1169/79/20241777

The Measures to Solve the US Subprime Crisis and Inspirations

This paper focuses on the subprime mortgage crisis in the United States at the beginning of the 21st century, and analyzes how this crisis was formed through chain transmission from the perspective of financial bonds in the real estate industry. The paper focuses on the Federal Reserve's policy adjustments and the collapse of the banking system, in order to elucidate the severe impacts of the subprime crisis on the US financial system. Through data collection and attribution analysis, it intends to provide methods for preventing similar crises from happening again, including diversifying policy tools, strengthening supervision, foreign exchange risk management, etc., and provide certain suggestions for the stable operation and resilience of the national financial system.

-

Open Access | Article 2024-04-26 Doi: 10.54254/2754-1169/79/20241779

The Impact of Liquidity Risk on Corporate Bond Pricing in China

This paper investigates the impact of liquidity risk on bond pricing in the bond market after the end of COVID-19. The paper hypothesizes a significant impact of liquidity risk on bond pricing in the bond market and introduces several variables such as liquidity ratio, coupon rate, issuance cycle, return on equity (ROE), and issuance volume for testing. The paper analyses and compares the impact of liquidity risk on corporate bond pricing through least squares (OLS) regression analysis (data from the iFinD database). The study shows that the liquidity risk of bonds has a significant impact on the market interest rate of corporate bonds, which directly proves that the impact of liquidity risk on corporate bond pricing in the bond market is highly significant. This paper reveals that liquidity risk is crucial to bond pricing in the bond market that liquidity risk is a key factor in determining the degree of stability of bond prices, and that illiquidity leads to increased uncertainty in bond pricing and market volatility. Investors need to have a more comprehensive perspective to rationally price bonds under the disturbance of liquidity risk and pay attention to the impact of liquidity risk on the bond market.

-

Open Access | Article 2024-04-26 Doi: 10.54254/2754-1169/79/20241781

Research on the Collaborative Effects of Live-streaming Sales and Community-based Supply Chain: A Case Study of “He Shi You Xuan”

The development of the digital economy has led to an increasingly close integration of e-commerce and supply chains. Many businesses have introduced live streaming for product promotion to boost sales and reduce shopping costs for users. China's vast online population provides extensive opportunities for the development of e-commerce. Previous research on e-commerce and supply chains has primarily focused on the impact and challenges that e-commerce poses to supply chain management. However, there is limited research on the key aspects affecting customer experience. The analysis covers various aspects, including logistics cost control, time cost control, service levels, user stickiness, inventory backlog, and live streaming cost control. By examining this novel combination of e-commerce and community-based supply chains, the paper aims to provide theoretical insights for exploring and optimizing the integration of e-commerce and community-driven supply chain models, ultimately enhancing e-commerce services.

-

Open Access | Article 2024-04-26 Doi: 10.54254/2754-1169/79/20241785

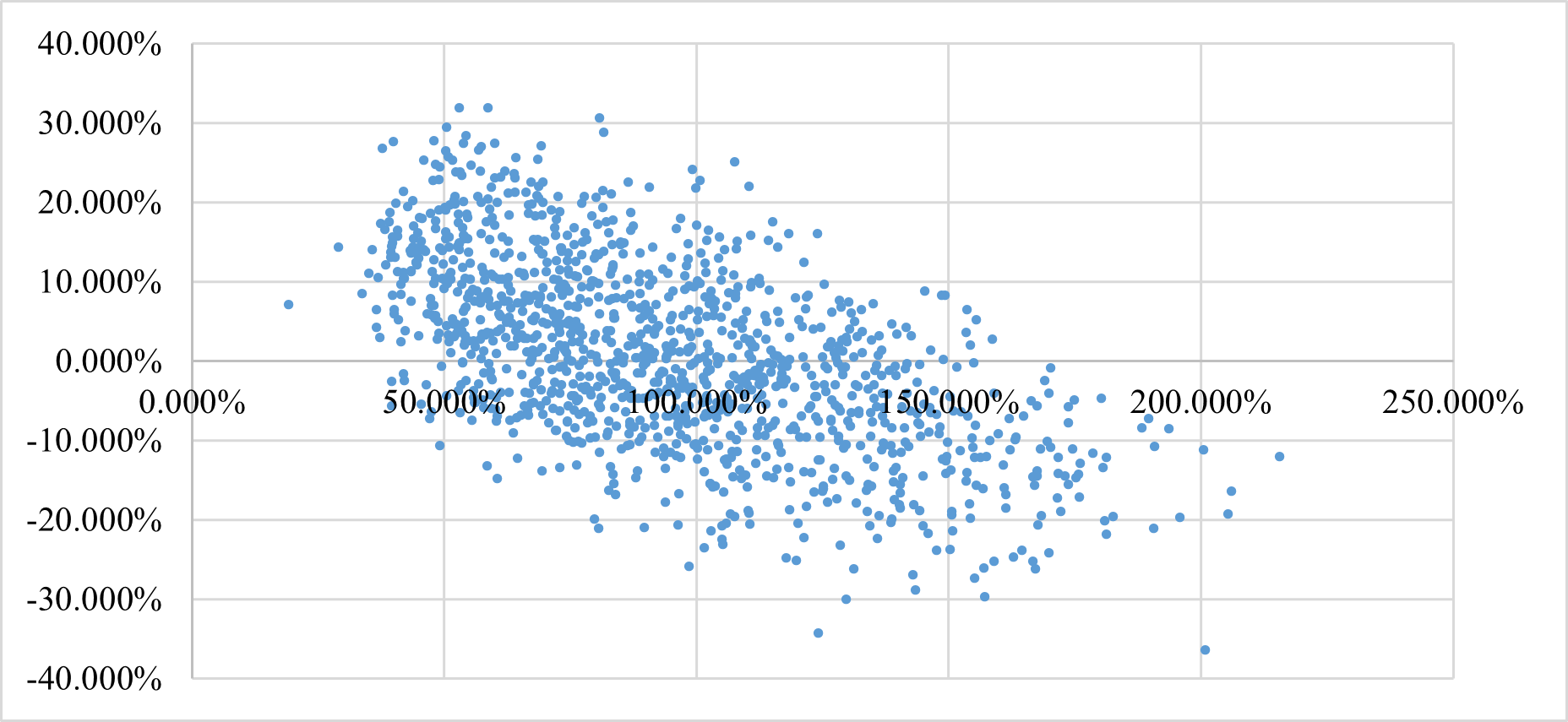

The Optimal Portfolio of AIA Group Limited’s Investment Insurance Products Based on Markowitz Model and Index Model

This paper uses the Markowitz and Index models to look for the optimal portfolio of AIA Group Limited’s Investment Insurance Products. While most of the previous articles concerning these two models only studied theoretically, the research object of this paper is more practical and instructive. First, this paper’s study method is to collect ten AIA investment insurance products’ revenue data from 2018 to 2023 from its website. Then, process the data, such as calculating the mean, variance, etc. Markowitz and Index Model are built on the basis of these data. The constraints are then introduced to find the optimal portfolio under different conditions. After comparison, it concludes that the Index Model analyzes the risk, while the Markowitz Model portfolio has the potential to yield higher returns than the Index Model portfolio when both are subject to the same level of risk. This research is instructive for investors finding the most suitable portfolio with the highest return and AIA developing new portfolio insurance products.

-

Open Access | Article 2024-04-26 Doi: 10.54254/2754-1169/79/20241787

The Effect of Technology Transfer Efficiency of Policies for Coordinated Development in the Beijing Tianjin Hebei Region: Evaluate by Using a Difference-in-differences Model

This paper uses the DID model to explore the impact of the implementation of the Beijing-Tianjin-Hebei coordinated development in 2014 on the efficiency of technology transfer in China. A comparative study was selected for the 6 years before and 5 years after the implementation of the policy. The technology transfer efficiency is calculated by the CCR and SBM of the DEA model. The scale of urban development and the financial capacity of the government are the control variables, which proves that the policy can improve the efficiency of regional technology transfer. The model passed parallel trend test and placebo test.

-

Open Access | Article 2024-04-26 Doi: 10.54254/2754-1169/79/20241789

The Impact of Educational Investment on Economic Development in Society

This paper explores in depth how China's investment in education since the 21st century has had a significant impact on the country's economic development. With the advent of globalization and knowledge-based economy, education has become a key factor to promote social progress and enhance national competitiveness. This paper analyzes the financial support of the Chinese government in basic education, higher education and vocational and technical education, and examines the positive effects of these investments on the optimization of the labor market, scientific and technological innovation capacity and the overall economic structure. In future development, more attention should be paid to improving the per capita education level rather than merely pursuing quantitative expansion. This means that we must make reasonable policies to guide resources to poor areas and narrow the gap between urban and rural areas. Improving the continuing education system; Encourage enterprises to participate in vocational and technical training; And to strengthen the construction of teachers and curriculum reform and other soft power investment. Only such a comprehensive and in-depth education reform and development strategy can ensure the steady and rapid growth of the national economy while having the inherent resilience to resist external risks and challenges, and achieve sustainable prosperity in the true sense.

-

Open Access | Article 2024-04-26 Doi: 10.54254/2754-1169/79/20241790

Analyzing the Impact of Social Network Position on Firm Performance: A Comprehensive Study

This study attempts to clarify the complex relationship that exists between social networks and corporate performance by introducing price and selling capacities as well as trust as a mediating component. A structural equation model was created using the body of existing research as a basis, and 380 small and medium-sized businesses (SMEs) in Indonesia participated in a survey to provide empirical data. The results show that, in the absence of social network trust, the use of social media in the management process by itself has no effect on the performance of the company. It becomes clear that trust is a major accelerator for the growth of selling and pricing skills, which in turn improves company performance. The survey highlights how important selling and pricing skills are when it comes to using social media, especially when it comes to developing trust. Although the research mostly focuses on small-to-medium-sized businesses and offers insightful information, generalizability to other contexts should be handled cautiously. In order to improve selling skills and expand corporate networks, managers should proactively use social media to improve overall company performance. In conclusion, trust is shown to be a critical mediator between social networks and corporate performance, emphasizing the need for trust in utilizing social media for better management and overall business success.

-

Open Access | Article 2024-04-26 Doi: 10.54254/2754-1169/79/20241794

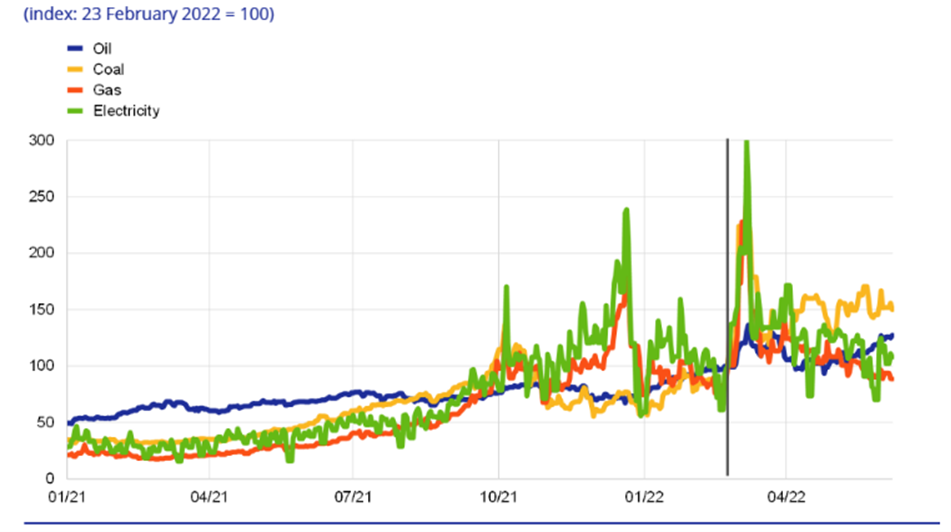

An Analysis on Hedging Strategies of Corporates under Ukraine Conflict

The Russia-Ukraine conflict has precipitated significant market volatility, notably affecting the energy and agricultural sectors. This paper offers a concise analysis of corporate hedging tactics in this tumultuous context. Specifically, it examines the energy sector's reaction to fuel price escalations and supply disruptions, highlighting Trafigura Group's revised risk management strategies utilizing financial derivatives to combat market unpredictability. Concurrently, the paper scrutinizes the Louis Dreyfus Company's (LDC) strategic response within the agricultural domain, acknowledging DC's proactive risk management measures, including asset insurance, alternative operational frameworks, and advanced risk assessment protocols. Additionally, the paper delves into the strategic allocation of gold as a corporate hedging instrument amidst geopolitical strife, evaluating its historical efficacy, crisis performance, and status as a potential financial refuge. The discourse concludes by articulating the imperative for adaptive, ongoing recalibration of corporate hedging strategies, underlining the integration of conventional assets like gold for comprehensive risk management amidst the ongoing Russia-Ukraine crisis.

-

Open Access | Article 2024-04-26 Doi: 10.54254/2754-1169/79/20241800

Literature Review on Chinese New Energy Investment Research

With the rapid development of China’s new energy industry, the new energy investment market has attracted widespread attention from various sectors of society. In response to this, academic research on new energy investment has become increasingly abundant. This paper conducts a comprehensive review and summary of literature related to Chinese new energy investment, focusing on three aspects: “Market and Participants,” “Influences and Values,” and “Investment Strategies and Risk Management.” The main research perspectives from relevant literature are extracted and synthesized. Additionally, the paper analyzes and summarizes the existing shortcomings in research areas, providing directional suggestions for future academic research.

-

Open Access | Article 2024-04-26 Doi: 10.54254/2754-1169/79/20241803

Research on the Application of Green Supply Chain Management: Based on SCOR Model

This paper takes Apple Inc. as the research object and explores the green supply chain management issues based on the SCOR model. By combining the SCOR model through the theoretical framework and the characteristics of Apple's supply chain, management practice suggestions are made to reveal Apple's green performance in terms of environment, resources, and social responsibility. The study results show that Apple performs better in green procurement and marketing, but is slightly inferior in green recycling storage, and transportation. This provides valuable ideas for Apple's subsequent industrial sustainable development strategy, as well as lessons and references for other companies and industries, helping to promote the green development of the entire supply chain industry. In the future, it will be a key area to continue in-depth research on promoting and optimizing green supply chain practices in different industries and enterprises of different sizes.